Southern California’s real estate market remained geared towards buyer's in the month of June despite relatively strong demand from investors and others paying cash for homes. Real estate prices had trended up slightly over the last couple of month, but many potential home buyers appear to still be on the sidelines and may still be waiting for a bottom in prices or a relaxing of the mortgage guidelines to allow more people to qualify for homes. As such, we have seen a weakening in pricing over the last few weeks as inventory appears to be climbing.

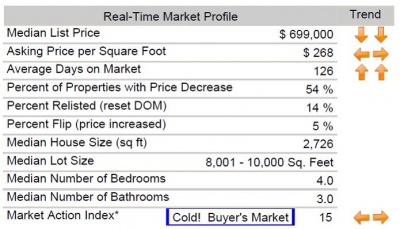

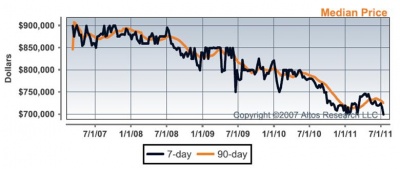

As of July 17, 2011, the median price for single family detached real estate in Carlsbad was $699,000; another slight down tick from a week ago. The seven day median real estate price average has been trending down, as showing in the graph below; but this week made a sharp downward move. With Carlsbad real estate inventory still trending up, there appears to still be continued downward pressure on real estate prices in Carlsbad. We need to see the 7 day average move back across the 90 day average to show a longer term uptrend in Carlsbad real estate prices. We are hopeful that this latest move is a retouch of the lows back in Januarya and early February, and this double bottom will signal a new uptrend.

The current environment appears to be in the home buyers favor, and we will need to see either more real estate being sold to reduce housing inventory, or Carlsbad real estate prices migrating back up (creating a sense of urgency among realestate buyers), to move out of the current market cycle. Days on market have been flat over the last two weeks, holding at a current average of 126, but up from a month or so ago; indicating a possible weakening in the market conditions. The strongest price point right now seems to be in the third pricing quadrant at a median price of $635,000, with an average days on the market of 103. The average size of the real estate in this quadrant is 2414 square feet.

If Carlsbad real estate inventory and days on market continue to climb, we could see continuing weakness in the market.

Leave A Comment